About Instacar

Flexible car leasing plans, offering the possibility of getting new or slightly used cars from official Greek dealerships, easily, quickly, and for as many months as the customer wants, on a monthly subscription basis.

The Challenge

The Solution

Create an automated document processing system to read, verify, and extract documents to examine the creditworthiness of a customer.

Car leasing company, leverages ML to assist in the customer creditworthiness verification process before getting a leasing agreement.

How Big Blue helped

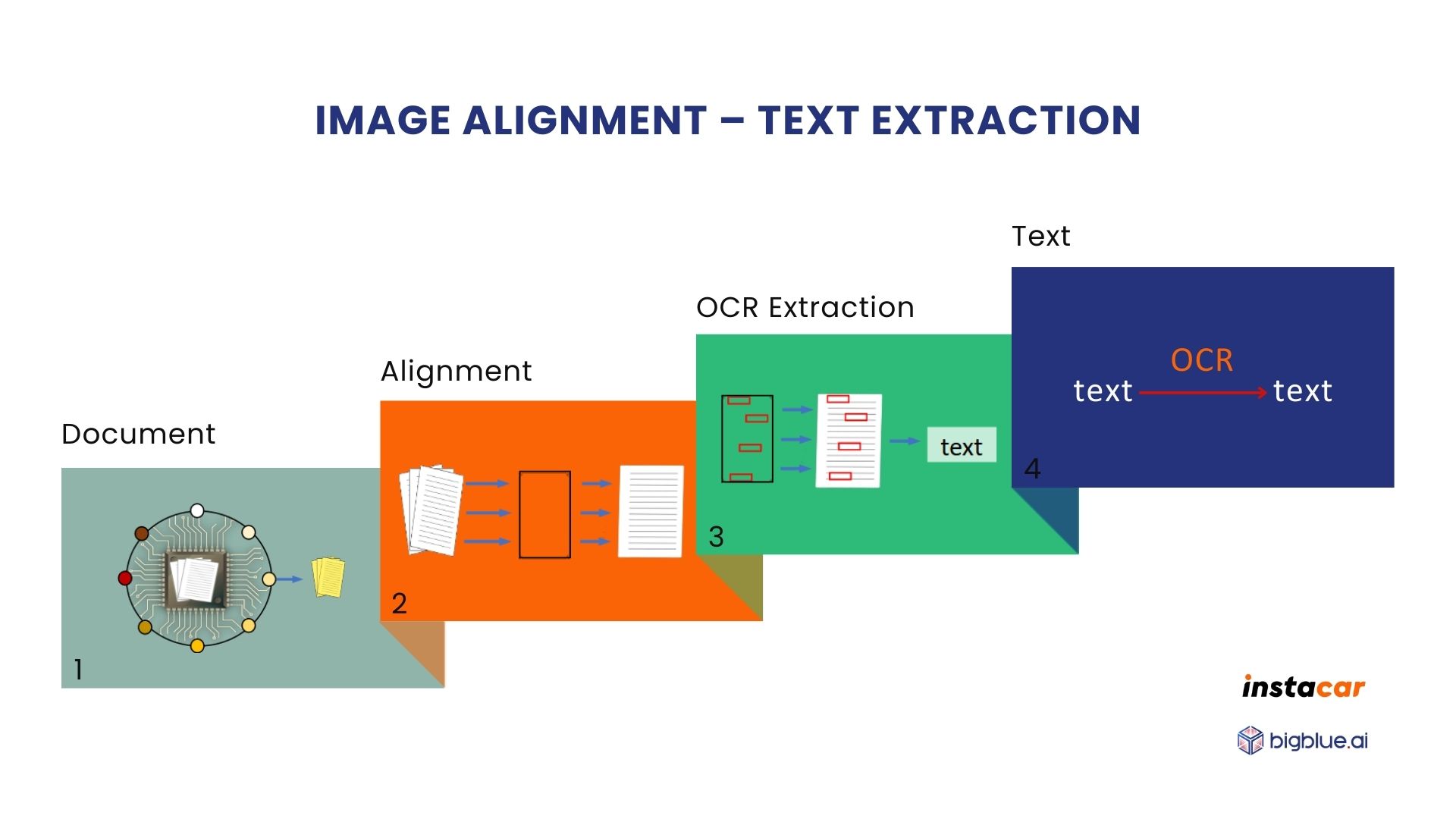

We created an automated document processing system that allows users to gather all required information and documents, upload them, and validate their quality.

Once the documents are admitted, and thanks to the use of a neural network, their category is defined. To complete the procedure, an Optical Character Recognition model helps extract the necessary data and move on with the creditworthiness verification process.

The impact

With a more efficient way of collecting and processing documents, that identifies documents and their quality, facilitating the procedure for both the customers and the company’s internal stakeholders, Instacar has:

The AI model Big Blue used, helps the company speed up and also focus on other value-added tasks so as to remain competitive.